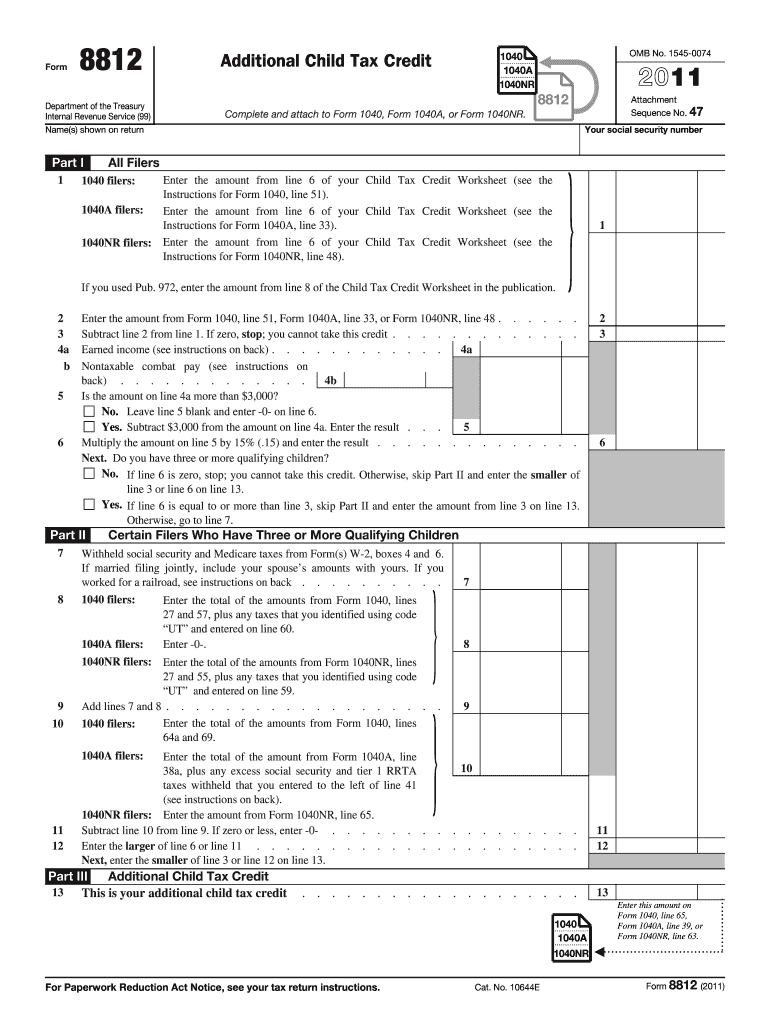

8812 Credit Limit Worksheet A

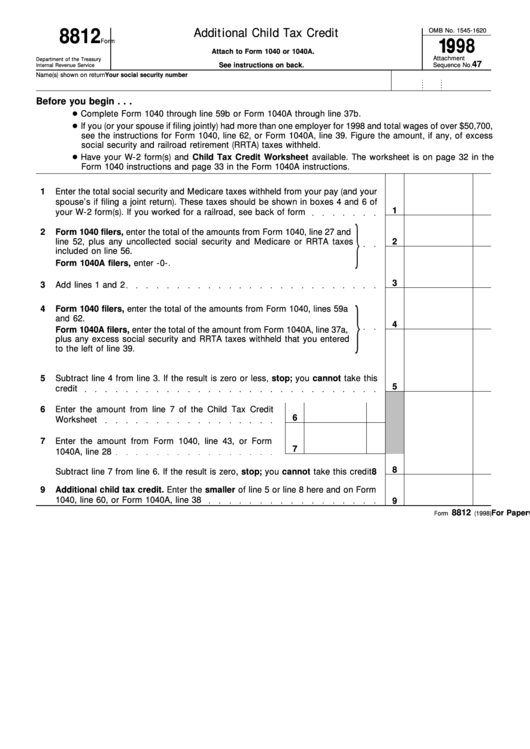

8812 Credit Limit Worksheet A - Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. This is a pdf form for calculating your credit limit for certain tax credits. Line 4 of schedule 8812 is more than zero.. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. There are several worksheets you might need to complete as you go through irs schedule 8812: Otherwise, enter the amount from the credit. For all returns except tax. It shows how to enter the amounts from your tax return and other.

Line 4 of schedule 8812 is more than zero.. This is a pdf form for calculating your credit limit for certain tax credits. There are several worksheets you might need to complete as you go through irs schedule 8812: It shows how to enter the amounts from your tax return and other. For all returns except tax. Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. Otherwise, enter the amount from the credit. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21.

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. It shows how to enter the amounts from your tax return and other. Otherwise, enter the amount from the credit. There are several worksheets you might need to complete as you go through irs schedule 8812: This is a pdf form for calculating your credit limit for certain tax credits. Line 4 of schedule 8812 is more than zero.. For all returns except tax.

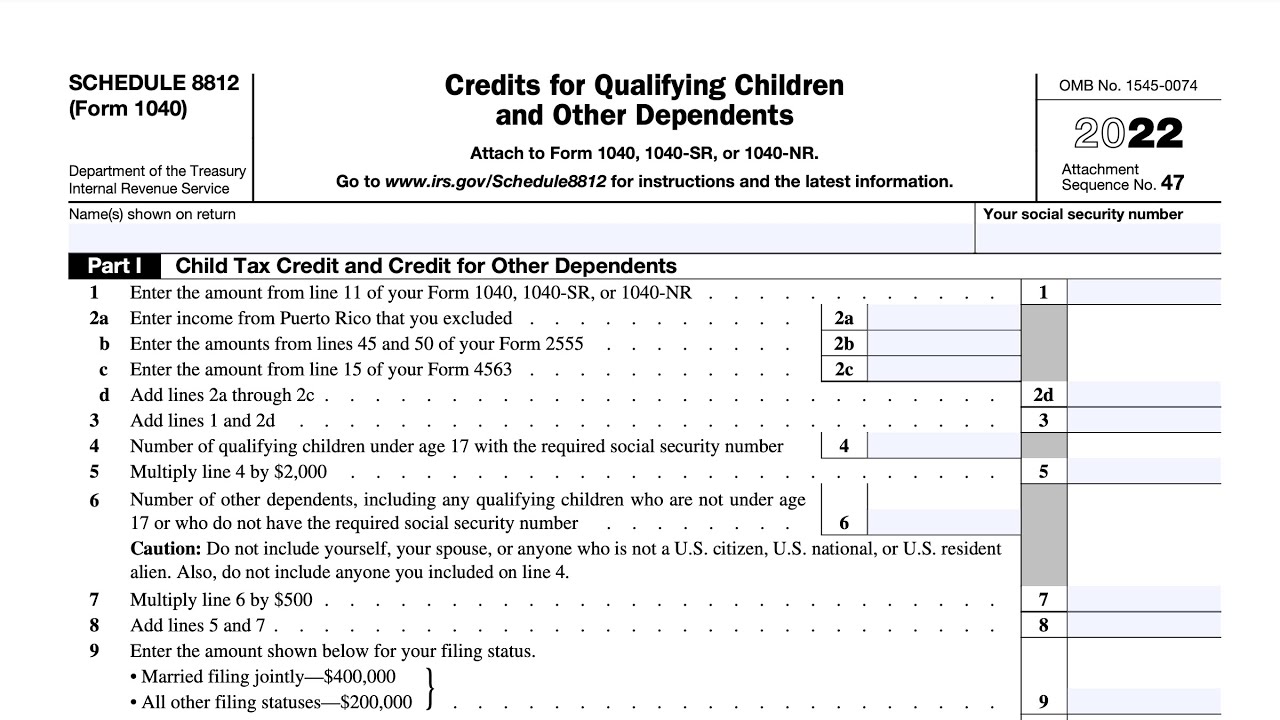

2022 Schedule 8812 Credit Limit Worksheet A

For all returns except tax. Otherwise, enter the amount from the credit. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. Line 4 of schedule 8812 is more than zero.. There are several worksheets you might need to complete as you go.

8812 Credit Limit Worksheet A 2023

The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. Line 4 of schedule 8812 is more than zero.. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter.

Line 5 Worksheets Schedule 8812

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. For all returns except tax. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax. There.

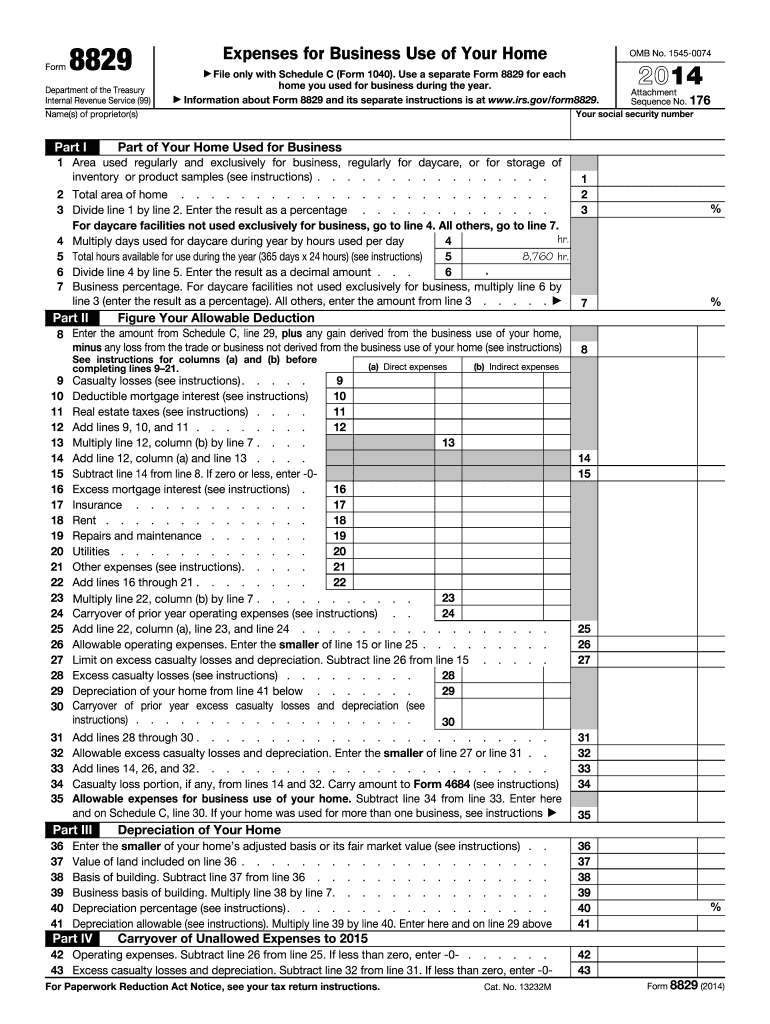

Form 8812 Credit Limit Worksheet A Printable Calendars AT A GLANCE

It shows how to enter the amounts from your tax return and other. There are several worksheets you might need to complete as you go through irs schedule 8812: Line 4 of schedule 8812 is more than zero.. For all returns except tax. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this.

Schedule 8812 Credit Limit Worksheet A

Otherwise, enter the amount from the credit. There are several worksheets you might need to complete as you go through irs schedule 8812: If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. For all returns except tax. Review the child tax credit.

Irs Form 8812 Credit Limit Worksheet A

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. For all returns except tax. Otherwise, enter the amount from the credit. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the.

2023 Schedule 8812 Credit Limit Worksheet A

This is a pdf form for calculating your credit limit for certain tax credits. Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. It shows how to enter the amounts from your tax return and other. For all returns except tax. There are several worksheets you might need to complete.

Form 8812 Credit Limit Worksheet A 2022

Line 4 of schedule 8812 is more than zero.. It shows how to enter the amounts from your tax return and other. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. Review the child tax credit and credit for other dependents worksheet.

Schedule 8812 Instructions Credits for Qualifying Dependents

This is a pdf form for calculating your credit limit for certain tax credits. For all returns except tax. Otherwise, enter the amount from the credit. Line 4 of schedule 8812 is more than zero.. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on.

Schedule 8812 Line 5 Worksheet 2021

Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this worksheet to figure the amount to enter on line 21. This is a pdf form for calculating your credit limit for certain tax credits..

If Your Employer Withheld Or You Paid Additional Medicare Tax Or Tier 1 Rrta Taxes, Use This Worksheet To Figure The Amount To Enter On Line 21.

Otherwise, enter the amount from the credit. It shows how to enter the amounts from your tax return and other. This is a pdf form for calculating your credit limit for certain tax credits. The schedule 8812 credit limit worksheet a is an important form that taxpayers may need to fill out when claiming the child tax credit on their tax.

For All Returns Except Tax.

There are several worksheets you might need to complete as you go through irs schedule 8812: Review the child tax credit and credit for other dependents worksheet to see whether they qualify for the credit. Line 4 of schedule 8812 is more than zero..