California Itemized Deduction Worksheet

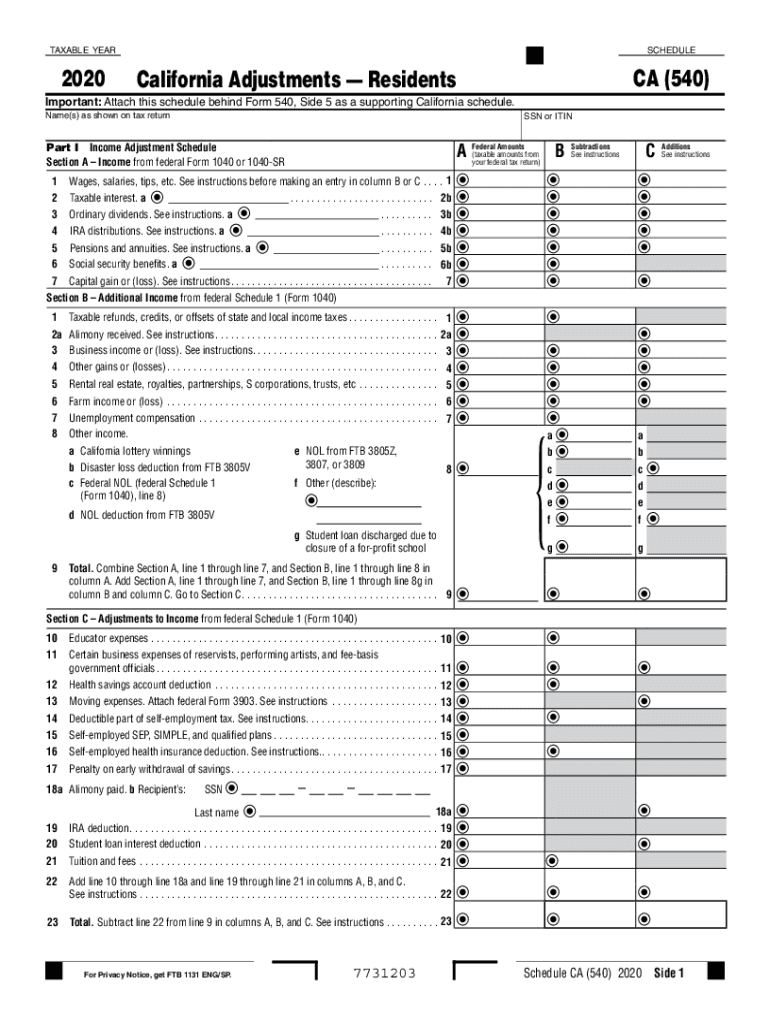

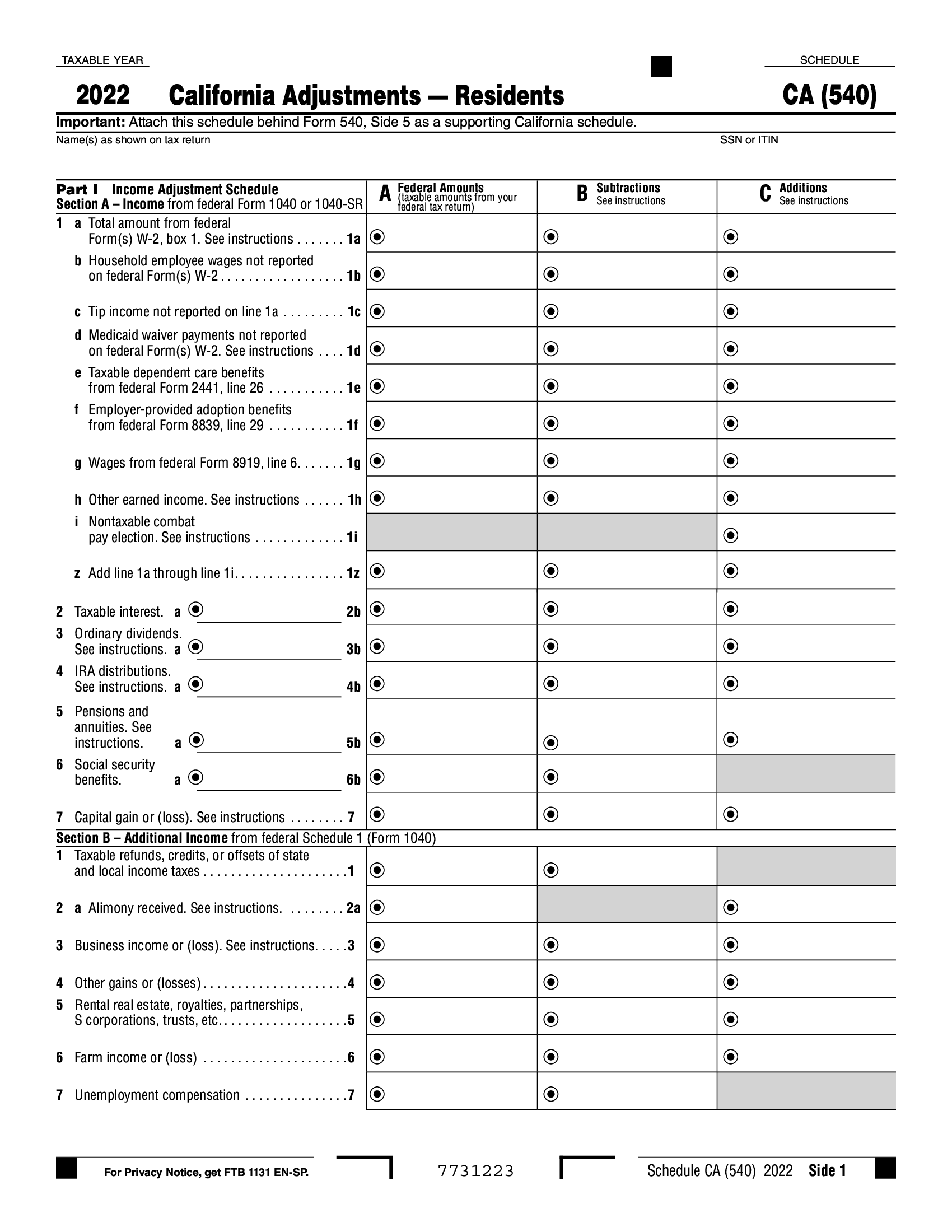

California Itemized Deduction Worksheet - Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Deduction, see form 1040 line 12. If you expect to itemize deductions on your california income tax return, you can claim additional withholding allowances. Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. Itemized deductions are expenses that you can claim on your tax return. Single, mfs= $5,540 for fed std. Deduction mfj, qss, hoh = $11,080; They can decrease your taxable income. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the.

Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. Deduction mfj, qss, hoh = $11,080; Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Single, mfs= $5,540 for fed std. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. If you expect to itemize deductions on your california income tax return, you can claim additional withholding allowances. Itemized deductions are expenses that you can claim on your tax return. Deduction, see form 1040 line 12. They can decrease your taxable income.

Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. They can decrease your taxable income. Itemized deductions are expenses that you can claim on your tax return. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. Deduction, see form 1040 line 12. If you expect to itemize deductions on your california income tax return, you can claim additional withholding allowances. Deduction mfj, qss, hoh = $11,080; Single, mfs= $5,540 for fed std.

A List Of Itemized Deductions

Itemized deductions are expenses that you can claim on your tax return. They can decrease your taxable income. Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. Deduction, see form 1040 line 12. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by.

Ca Itemized Deduction Worksheet Printable Word Searches

Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. Itemized deductions are expenses that you can claim on your tax return. Single, mfs= $5,540 for fed std. They can decrease your taxable income.

Standard Deduction Worksheets For Dependents

Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. Single, mfs= $5,540 for fed std. If you expect to itemize deductions on your california income tax return, you can claim additional withholding allowances. Deduction mfj, qss, hoh = $11,080; If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest.

Itemized Deductions Worksheet Ca 540

If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. Deduction, see form 1040 line 12. Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. Itemized deductions are expenses that you can claim on your tax return. Deduction mfj, qss, hoh =.

Understanding the Standard Deduction 2022 A Guide to Maximizing Your

Deduction, see form 1040 line 12. Itemized deductions are expenses that you can claim on your tax return. If you expect to itemize deductions on your california income tax return, you can claim additional withholding allowances. Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. Complete the itemized deductions worksheet in the instructions for.

California Itemized Deduction Worksheet 2023

Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. Itemized deductions are expenses that you can claim on your tax return. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. They can decrease your taxable income. Single, mfs= $5,540 for fed.

Tax Itemized Deductions Worksheet

Deduction mfj, qss, hoh = $11,080; Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. Deduction, see form 1040 line 12. Itemized deductions are expenses that you can claim on your tax.

Printable Small Business Tax Deductions Worksheet Printable Calendars

Single, mfs= $5,540 for fed std. If you expect to itemize deductions on your california income tax return, you can claim additional withholding allowances. Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. They can decrease your taxable income. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction.

Itemized Deductions Worksheet Excel

If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. Single, mfs= $5,540 for fed std. Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. Deduction, see form 1040 line 12. Itemized deductions are expenses that you can claim on your tax.

Ca 540Es 2024 Amandy Rosanna

Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Itemized deductions are expenses that you can claim on your tax return. Deduction mfj, qss, hoh = $11,080; Single, mfs= $5,540 for fed std. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the.

If You Claimed Both The Mortgage Interest Certificate On Form 8396 And The Mortgage Interest Deduction On Schedule A (Decreased By The.

Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Single, mfs= $5,540 for fed std. Deduction mfj, qss, hoh = $11,080; Deduction, see form 1040 line 12.

Itemized Deductions Are Expenses That You Can Claim On Your Tax Return.

If you expect to itemize deductions on your california income tax return, you can claim additional withholding allowances. Navigate california's itemized deductions with insights on eligible expenses, income adjustments, and key differences from. They can decrease your taxable income.