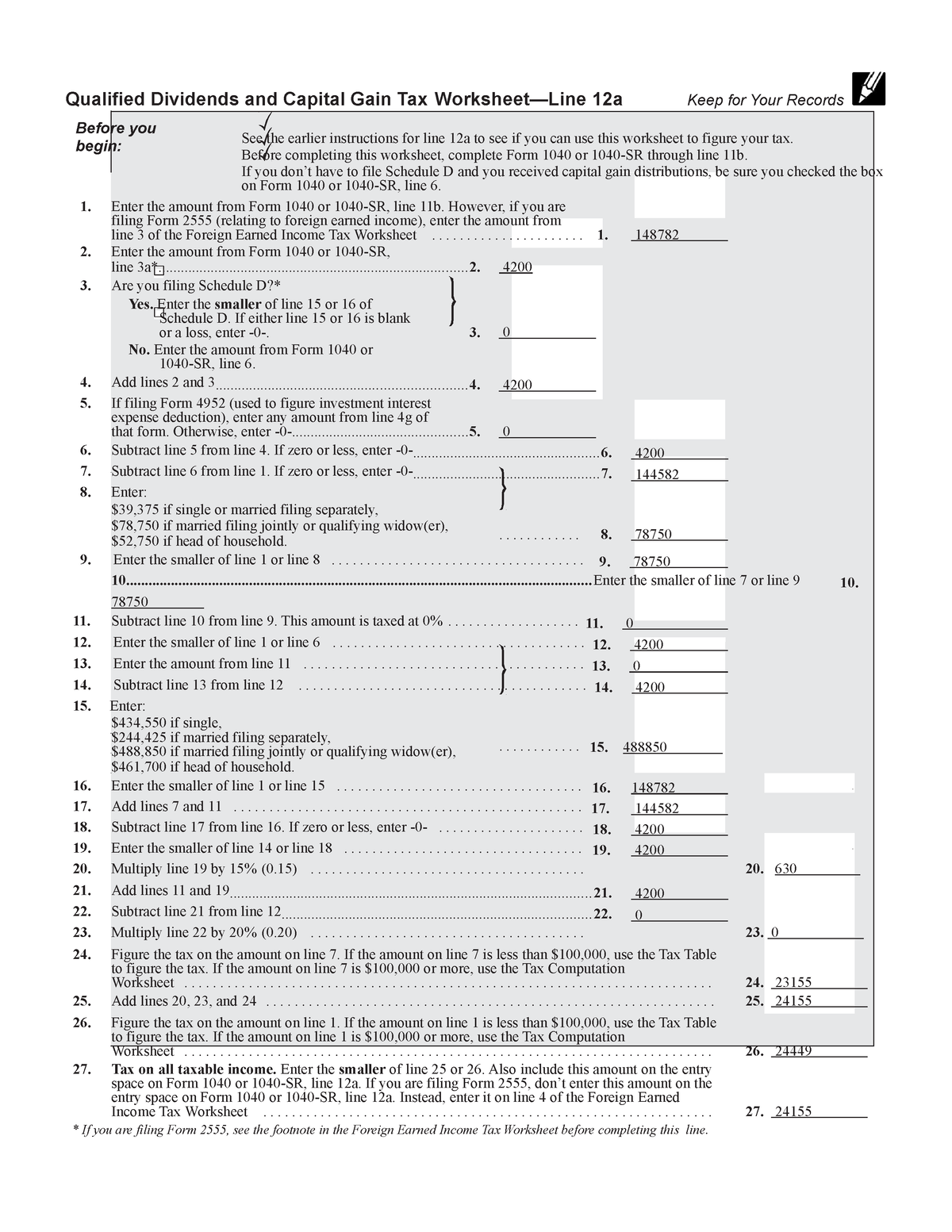

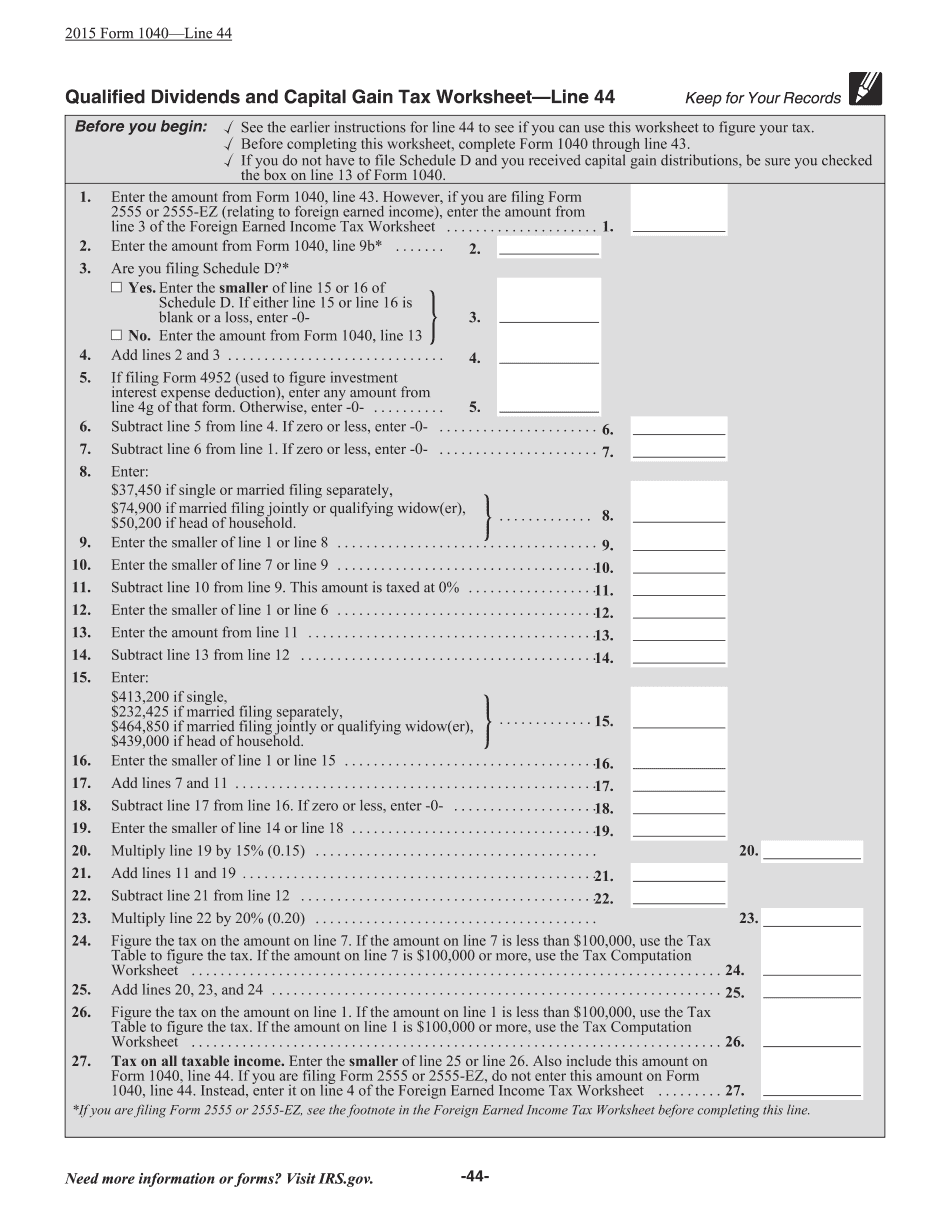

Fillable Qualified Dividends And Capital Gain Tax Worksheet

Fillable Qualified Dividends And Capital Gain Tax Worksheet - Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet. V / see the instructions for line 16 in. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? If “yes,” attach form 8949 and see its instructions for. These instructions explain how to complete schedule d (form 1040). The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. If you have those, you'll need to fill out the qualified dividends and capital gains tax worksheet next. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule.

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. V / see the instructions for line 16 in. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. If you have those, you'll need to fill out the qualified dividends and capital gains tax worksheet next. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet. These instructions explain how to complete schedule d (form 1040). The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. If “yes,” attach form 8949 and see its instructions for.

If you have those, you'll need to fill out the qualified dividends and capital gains tax worksheet next. If “yes,” attach form 8949 and see its instructions for. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. V / see the instructions for line 16 in. These instructions explain how to complete schedule d (form 1040). Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule.

Irs Capital Gains And Dividends Worksheet

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? If you have those, you'll need to fill out the qualified dividends and capital gains tax worksheet next. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet. If “yes,”.

1040 Qualified Dividends And Capital Gain Tax Worksheet Prin

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. These instructions explain how to complete schedule d (form 1040). Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet. The qualified dividends and capital gain.

Qualified Dividends and Capital Gains Flowchart Worksheets Library

Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. V.

1040 Qualified Dividends And Capital Gain Tax Worksheet Prin

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. If “yes,” attach form 8949 and see its instructions for. V / see the instructions for line 16 in. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. These instructions explain how to complete.

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax.

Qualified Dividends And Capital Gain Tax Worksheet Calculato

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? If you have those, you'll need to fill out the qualified dividends and capital gains tax worksheet next. These instructions explain how to complete schedule d (form 1040). The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities.

Capital Gains And Dividends Worksheet Printable And Enjoyable Learning

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. These instructions explain how to complete schedule d (form 1040). Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet. V / see the instructions for.

2023 Qualified Dividends And Capital Gain Tax Worksheet Gain

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? If “yes,” attach form 8949 and see its instructions for. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do.

The Qualified Dividends & Capital Gain Tax Worksheet White Coat

Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet. V / see the instructions for line 16 in. These instructions explain how to complete schedule d (form 1040). Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule..

Qualified Dividends And Capital Gain Tax Worksheet 2022 Inst

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment. V / see the instructions for line 16 in. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do.

V / See The Instructions For Line 16 In.

If you have those, you'll need to fill out the qualified dividends and capital gains tax worksheet next. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? These instructions explain how to complete schedule d (form 1040).

If “Yes,” Attach Form 8949 And See Its Instructions For.

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet. The qualified dividends and capital gain worksheet is vital for taxpayers aiming to optimize their tax liabilities on investment.